It’s difficult writing about financial and economic matters when health is quite rightly at the top of everyone’s agenda. We aren’t qualified to tell you how long this epidemic will last, but we can give you some information about investing which might give you some peace of mind now and ideas for the future.

How long will this market downturn last?

The circumstances behind this market downturn are unique. We’ve seen people go back to the 1918 Spanish Flu pandemic for comparisons. So any attempt to predict when we reach the bottom of the market and how long it will last is really guesswork at this stage. However, history can give us some comfort, if we take previous crashes as a series of unique events.

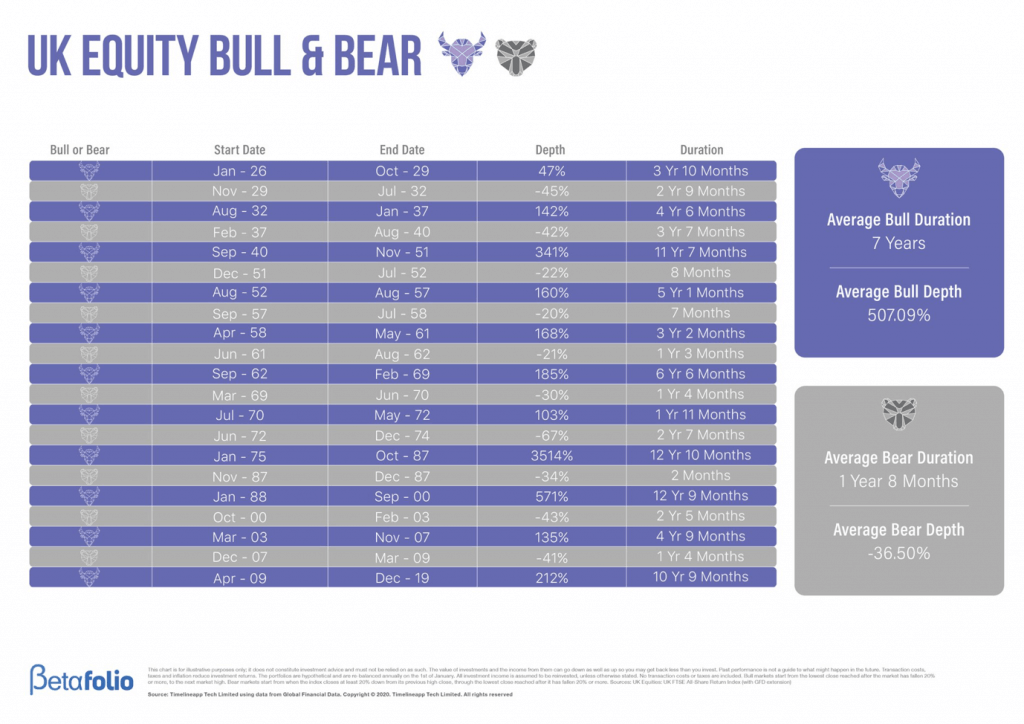

The table above shows almost 100 years of market conditions. A bear market, where market prices fall more than 20%, is not uncommon. This can be expected as part of the normal functioning of equity markets, and your own financial plan is built to expect them. We don’t know how long this one will last but we do know that in each unique circumstance since 1926, human ingenuity has responded to change market conditions within an average timescale of 1 year 8 months.

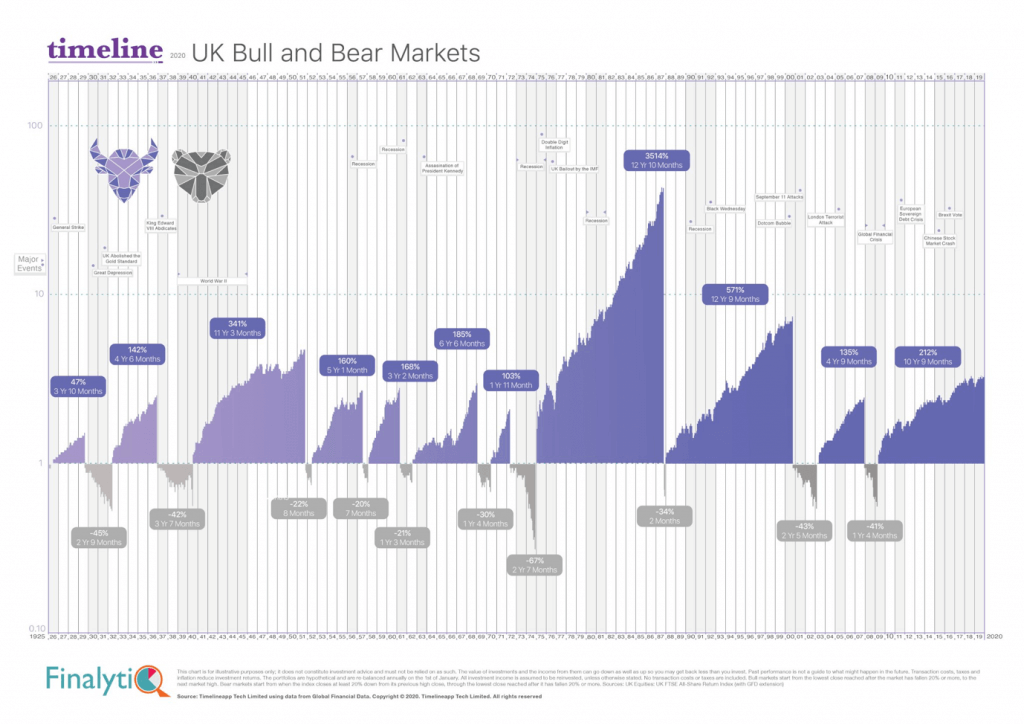

As you can see from the alternative way of viewing the same data in the illustration below, bull markets have always rewarded patience by more than compensating for downturns over the long term.

Diversification

This might be small comfort for those of you watching a FTSE index drop dramatically on the news right now but remember, your own portfolio is not a replica of the FTSE100, although it will have some of those businesses in it. The FTSE100 should paint a far worse picture than the reality for your own portfolio.

Your money is invested in a globally diverse portfolio of investments, and not just in equity markets. So whilst the UK is coming to the forefront of the pandemic, your own money is invested elsewhere. Diversification not only helps buffer you a little against downturns, it will also increase your chances of capturing a recovery early as things improve at different times in other countries around the world.

We can’t predict the future but we can rely on mathematics

It sounds glib but so many people buy at the top of the market and sell at the bottom. Panic selling investments is as common as panic buying in supermarkets, however irrational both may be.

We don’t know when the equity markets will hit rock bottom and start their recovery. If we did, we would invest all of our spare cash precisely then. Some investors will be comfortable investing spare cash to top up pensions and ISA allowances right now. Some may be more cautious and want to drip money in each month. The benefit of dripping money every month is that whilst you will never benefit from investing at the best possible time, you are also ensuring that you are not investing at the worst time. You effectively buy at the average price. This is known as ‘pound cost averaging’. It’s a good defensive strategy although over the longer term, as the general market trajectory is upwards, its not always the optimal one.

There is no right or wrong way to invest money as it depends on individual circumstances. You might have a small amount of money left to invest into your pension or ISA before the tax year end which necessitates a lump sum. You might want to establish some long-term behaviours and pound cost averaging is a good way to start saving on a monthly basis. This is where our advice will differ from client to client.

Equally for anyone drawing an income from their portfolio, pound cost averaging works in reverse. Withdrawing income from an equity portfolio during a significant market downturn such as this one, has a damaging impact on the recovery rate of your investment portfolio. Again this is simply a case of using maths and not predicting market changes. In a market downturn, creating income by selling investments in equal and regular intervals means selling funds when prices are low and fewer when they are high–exactly the opposite of what you want.

For this reason, we always recommend that you withdraw the income that you need from cash reserves or other better protected assets than your investment portfolio.

Sticking to the plan

This is a core aspect of our approach to managing not just your money but your behaviour towards it. Many people who do not have an adviser will act impulsively at this time and lose the long-term benefits of their hard-earned investments. Even with all the right investment decisions made previously, one impulsive or impatient decision can undo it all.

It might seem counter intuitive to do little or nothing with your investment portfolio at this time, but we will advise you of everything that you need to do at the right time.

Our service to you will continue almost as usual over the forthcoming months, and we will be in contact with you as planned, albeit certain work may take a little longer and we will begin to use online meetings or telephone to conduct review discussions rather than face-to-face, for obvious reasons.

For reasons outlined above, you need not be concerned that we aren’t recommending wholesale changes to your portfolio. You should also feel free to contact us at any time if you are concerned or have questions about your investments or broader financial affairs, we are available and ready to help.

Disclaimer

Hartcliff is a trading name of Hartcliff Limited, which is a limited company registered in England & Wales

No. 09321837 Registered Office: Marland House, 13 Huddersfield Road, Barnsley, S70 2LW

Hartcliff Limited is an appointed representative of Sense Network Limited, which is authorised and regulated by the Financial Conduct Authority

The information contained within this website is subject to the UK regulatory regime and therefore targeted at consumers in the UK.